All Categories

Featured

Table of Contents

[/video]

If you intend to become your own bank, you have actually pertained to the best area. Initially, do you understand how financial institutions take care of to be the wealthiest organizations in the globe? Allow's claim you transfer $10,000 in the savings account. Do you think the bank is going to rest on that money? The financial institution is going to take your down payment and offer it bent on a person who requires a new automobile or residence.

Did you know that financial institutions gain between 500% and 1800% even more than you? So, if the banks can essentially move cash and gain passion that way, would not you like to do the exact same? We would! As a matter of fact,. We've created our personal banking system, and we're even more than pleased to reveal you exactly how to do the very same.

Nelson Nash was having problem with high interest prices on commercial bank fundings, yet he efficiently did away with them and began instructing others how to do the exact same. Among our favored quotes from him is: "The really first principle that has to be recognized is that you fund every little thing you buyyou either pay interest to somebody else or you surrender the passion you might have earned or else." Prior to we describe this procedure, we intend to make certain you recognize that this is not a sprint; it's a marathon.

Bank On Yourself Review

An entire life insurance policy policy is a kind of long-term life insurance, as it gives life coverage as long as you pay the costs. So, the very first difference contrasted to term insurance is the period. That's not all. One more difference in between term insurance and whole life is the cash money value.

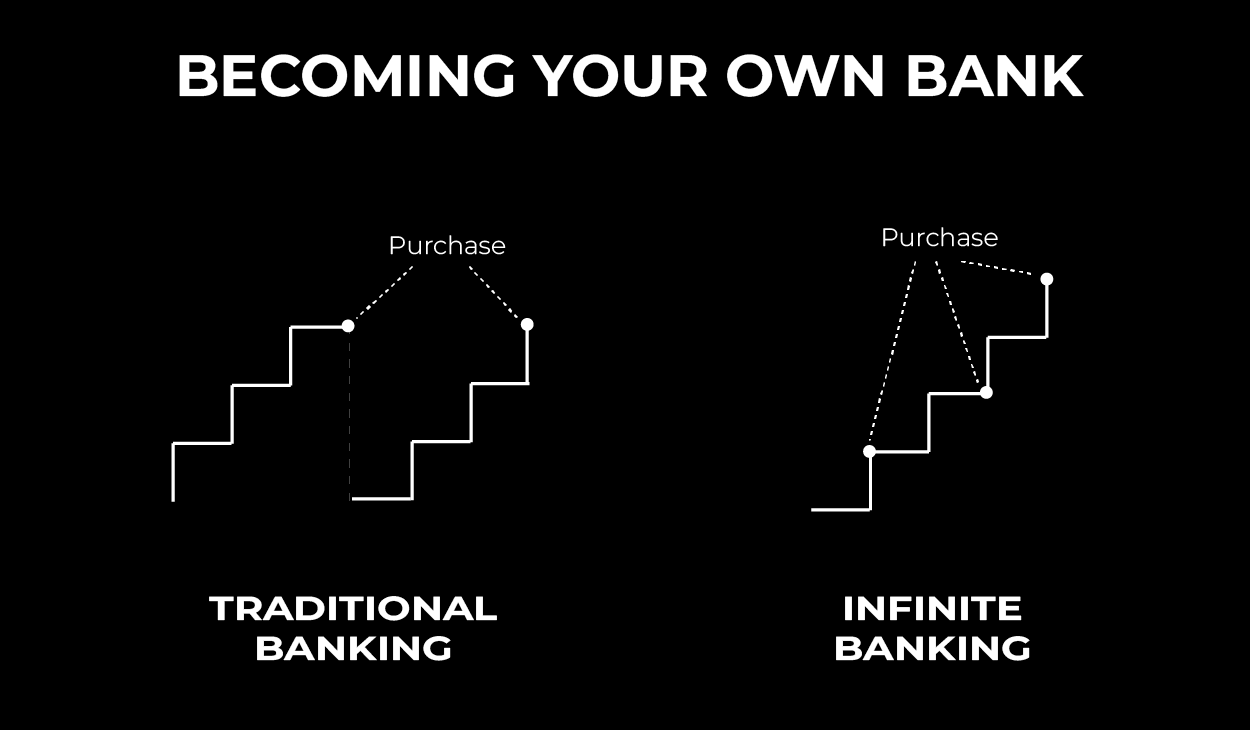

As we saw, in the typical financial system, you have a savings account where you transfer your money, which will certainly gain passion. However the problem is, we don't obtain wealthierthe financial institutions do. Given that we wish to copy the process of typical financial, we need a cost savings account that is autonomous.

You buy the whole life insurance policy from the insurance policy firm in the very same means that you would certainly any kind of other plan. It is feasible to acquire a policy on someone close to you to act as your own financial institution.

Becoming Your Own Banker Explained

Your policy needs to be structured properly in order to become your very own banker. As you probably know, insurance plan have monthly costs you require to cover. With a whole life, that quantity is assured for your entire life. Nonetheless, considering that we wish to utilize the entire life policy for individual financial resources, we have to treat it in different ways.

To put it simply, these overfunding repayments end up being quickly accessible inside your private household bank. The of this extra repayment is invested in a little portion of extra permanent survivor benefit (called a Paid-Up Addition or PUA). What's fantastic is that PUAs will no much longer need exceptional payments since it has actually been contractually paid up with this one-time settlement.

Your cash money well worth is increased by these Paid-Up Additions, which contractually start to boost at a (also if no rewards were ever before paid once again). The reasoning coincides as in traditional banking. Banks require our cash in financial savings accounts to get affluent, and we need our money in our interest-bearing accounts on steroids (whole life insurance policy) to start our individual financial strategy and obtain rich.

We desire to copy that. When your cash value has accumulated, it's time to start utilizing it. And below is the component of this process that requires imagination.

You don't need to wait for approval or worry regarding rejection.: When you take car loans, none of your money value ever before leaves your entire life insurance policy policy! Your complete cash money worth equilibrium, including the sum you obtained, maintains enhancing. The next action in the procedure of becoming your own lender is to repay the plan financing.

Byob (Become Your Own Bank)

Policy fundings do not appear on credit rating reports because they are a private contract in between you and the insurance policy company. You schedule when you pay rate of interest and principles. You do not need to pay anything till you can make a balloon repayment for the total amount.

No various other organization offers this level of flexibility to serve as your very own financial institution. You can intend some kind of reoccuring financing upkeep, but the insurance coverage agents do not demand it. We did claim that this is a four-step guide, but there is one extra action that we want to state.

There are limitless opportunities for exactly how you can utilize your own financial institution. If you still have some uncertainties, allow's see the distinction in between your individual financial institution and a standard one.

You have the versatility and power to establish your very own policies. You will certainly remove any kind of financial obligation you could have currently. You will certainly never have to pay interest, high fees, or charges to anyone. You will construct riches for your inheritors. Financial freedom. You can utilize your family financial institution for covering any expenditure.

Boundless banking is the only way to really finance your way of living the way you want it. That's why below at Wealth Country we like the term Way of living Banking. Exists anything else that you would certainly require to be your own bank? Possibly somebody specialist and dependable that can teach you all the nitty-gritty details of setting up your own financial system.

Visualize a globe where individuals have no control over their lives and are constrained to systems that leave them vulnerable. Photo a globe without self-sovereignty the capability to take control of one's financial resources and destiny.

Nelson Nash Reviews

The concept of self-sovereignty encourages individuals to make their very own choices without undergoing the control of effective central authorities. This concept has actually been around for fairly time. Self-sovereignty indicates that every individual has the power and liberty to make their very own decisions without being controlled by others.

Those that support this new economic system can now become their own financial institutions without requiring the conventional one. When you put your cash in a bank, you partially blow up of it. It becomes the bank's money to do as they see healthy, and only a portion is insured. Financial institution runs are still common today in lots of parts of the globe, and we've seen the collapse of the conventional banking system often times in the past century.

These pocketbooks give you single access to your funds, which are shielded by a personal secret only you can control. You can also access your cash anytime, regardless of what takes place to the business that made the pocketbook.

If it goes insolvent, you might lose your coins with little hope of getting them back. Nonetheless, if you utilize a non-custodial budget and keep your personal vital secure, this can't take place. Your money is saved on the blockchain, and you keep the private tricks. Discover more regarding why you shouldn't maintain your assets on exchanges.

Infinite Banking Scam

If you save it in a non-custodial pocketbook, there is no danger of a financial institution run or a hacking attack. Withdrawals from a budget are likewise less complicated and more secure. There is less opportunity of any person forcing the purse proprietor to do anything they do not intend to do. The budget owner can withdraw their funds without needing to ask for approval.

Latest Posts

Be Your Own Banker Concept

Non Direct Recognition Life Insurance

Is Bank On Yourself Legitimate